Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

In the last post, I showed you how a Hawaii vacation could cost as little as $22 using points and miles. Pretty unbelievable, right? Okay, so now that we know of several ways we can book a Hawaii vacation using points and miles, let’s explore how to earn the points we need – outside of those amazing welcome offers.

5 Ways To Earn Credit Card Points

As I mentioned in previous posts, welcome offers are the fastest way to earn the biggest chunk of points, but how do you earn points outside of those bonuses?

Here are 5 ways:

- Spend Categories

- Referrals

- Promo Offers

- Shopping Portals

- Travel

Let’s explore each of these…

Spend Categories

Spend categories are categories for your purchases, like grocery, dining, gas, travel, etc. Different credit cards offer various points earnings on different spend categories, so it’s important to pay attention to which card earns what in order to maximize your everyday purchases.

For example, my Amex gold card earns 4 points per dollar on restaurant and supermarket purchases, so that’s the card I reach for whenever we dine out or do a Kroger run. My Chase Freedom card earns 5 points per dollar on gas purchases, so that’s the card I use whenever I need to fill up the tank.

Referrals

Get rewarded when you refer your friends and family to credit cards. If they use your unique referral link to apply and their application is approved, you get a referral bonus that is often thousands of points! On the flip side, when folks just google the credit card website and apply that way, then the bank gets the credit, so encourage your friends and family to use your unique link to apply.

And if you don’t have a referral link, then please use your favorite travel content creators’ links (me!) – it’s so very much appreciated!

Promotional Offers

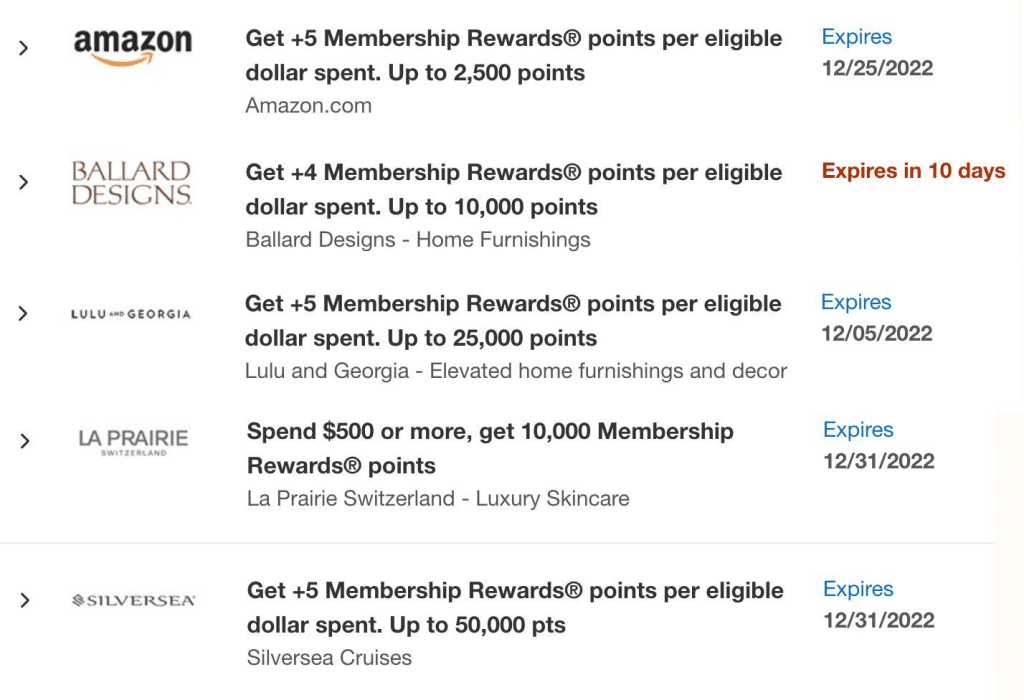

There are often promotional offers on credit cards. You typically have to opt-in to take advantage of these offers, so make it a habit to periodically sign into your accounts and check to see which offers are available to you. They change often and randomly and are either in the form of cash back or points.

For example, my Amex gold card is currently offering 5 additional points per dollar when I shop on Amazon. So, from now until Christmas (or whenever I reach the 2,500 max points), I’ll be using my Amex gold card to pay for all my Amazon purchases. Outside of this promo, I typically use my Chase Freedom Unlimited card, since it earns 1.5 points per dollar as opposed to my other cards, which earn only 1 point per dollar on Amazon.

Shopping Portals

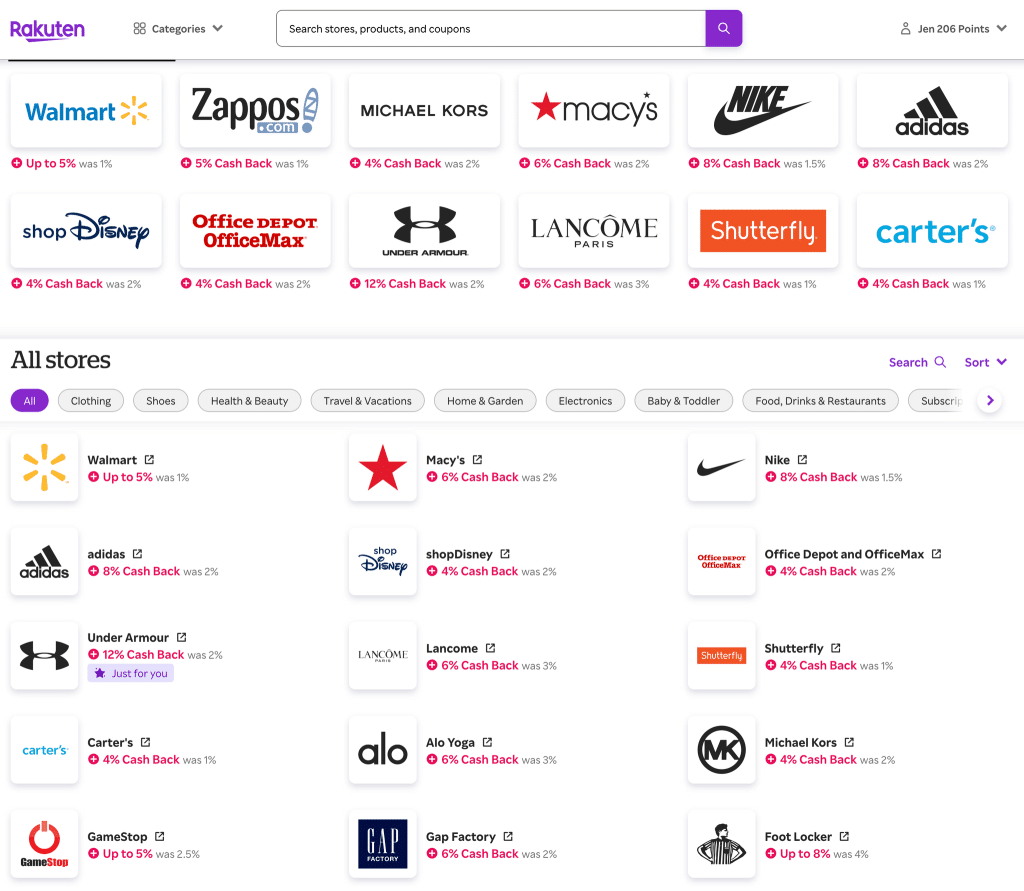

Shopping portals are sites that award you points or cash back for clicking through their site when you’re shopping online. Instead of going directly to the merchant’s website, you’ll click through the shopping portal site to get to the merchant site and earn points for your purchases.

Rakuten is a shopping portal I use most often because I can earn Amex points for all of my purchases. For example, as you can see below, I can earn 5 points for every dollar I spend at Zappos (which only further justifies and enables my shoe addiction). If I shop directly from Zappos.com, I typically only earn 1 point per dollar for my purchases. Shopping through a shopping portal doesn’t cost any extra or isn’t any less secure. You’re still shopping through the merchant’s site, you’re just making an extra click to get there. I do almost all of my shopping online, so why not get rewarded with credit card points for the shopping that I’m already doing, especially when it’s just an extra click?! You can also add the Rakuten browser extension to automatically get coupons, deals, cash or points back. Give it a try and see for yourself.

Travel

Last, but not least, you can earn points by traveling! What a novel idea – ha! When you book flights, hotels, cruises, rental cars, etc., you can earn points and miles, which you can then redeem for more travel.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply