Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

If you’re serious about earning points through credit card welcome offers, the truth is, keeping track of it all can get overwhelming. Which cards did you apply for? When did your welcome offer post? Are you eligible for a new bonus or will you be denied for applying too soon?

Every credit card issuer has its own set of rules. Some banks are more generous, others are strict, and a few are just plain confusing. And it’s not always about your credit score. You can have an 800+ and still get declined because you applied too quickly or didn’t meet a certain rule. That’s why it’s important to understand each bank’s guidelines and keep track of your applications over time. Strategy is everything.

I’ve created a free tracking spreadsheet you can download below. But first, let’s walk through the rules you’ll want to keep in mind.

Why the Rules Matter

One of the biggest mistakes people make when getting into travel points is applying for the wrong card at the wrong time. Not all banks play by the same rules. Each one has its own guidelines for eligibility, welcome bonuses, and how often you can apply.

If you’ve ever been denied for a card even with a great credit score, this might be why. Knowing the rules and keeping track of them is one of the best things you can do to build a long-term strategy that works.

The Major Rules, Bank by Bank

Let’s walk through the application rules for each of the big banks and what to watch out for before you hit submit.

Chase: The 5/24 Rule

Chase is often where I recommend people start, because of their 5/24 rule. It’s one of the most limiting policies in the credit card world.

- 5/24 Rule: If you’ve opened 5 or more personal credit cards (from any bank) in the past 24 months, you’ll likely be denied for a new Chase card.

- Authorized user cards often count toward your 5, even if you weren’t the primary cardholder.

- Business cards from most issuers usually don’t count against your 5/24 total.

- Chase is sensitive to how many Chase cards you’ve opened recently, so spacing matters.

- If you’re opening multiple Chase cards, I recommend applying for a business card first, then waiting at least 30 days before applying for the personal card.

If you’re just getting started, I always recommend beginning your strategy with Chase cards.

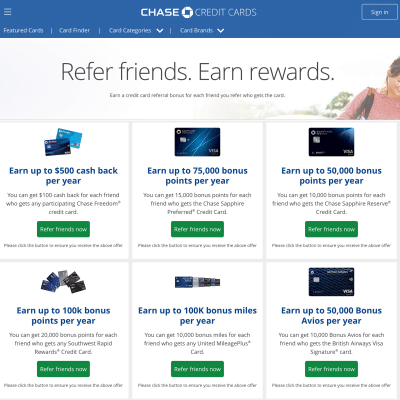

American Express: One Welcome Bonus per Lifetime

Amex generally allows you to earn the welcome bonus on each card once in your lifetime. So if you had a Gold card years ago and received the bonus, you likely won’t get it again if you reapply.

There are exceptions, but they’re rare.

The good news is that you can hold more than one “pay over time” card (like both the Gold and the Platinum), and you’re usually eligible for bonuses on different products.

Amex is generally more generous with approvals, especially once you’re an existing customer. But they also have some very specific rules around bonuses.

- You can hold up to 5 credit cards (plus any number of charge cards like the Platinum or Gold).

- They use a 2/90 rule, meaning you can’t be approved for more than 2 cards within 90 days.

- Amex typically lets you earn a welcome bonus on a specific card once per lifetime. So if you had a Gold card years ago and earned the bonus, you likely won’t be eligible for another Gold bonus.

They often use a soft pull for existing customers, which means if you’re not approved, it might not show up on your credit report.

Capital One

Capital One is a little tricky, and their approval decisions aren’t always easy to predict. Keep the following in mind:

- You can typically have no more than two Capital One personal cards at a time

- They tend to only approve one card every six months

- Some of their business cards show up on your personal credit report, which can affect things like Chase’s 5/24 rule

Because Capital One approvals can be hit-or-miss, I usually recommend working on Chase and Amex cards first.

Citi

Citi’s language in the fine print is often very specific, so always double-check eligibility before you apply.

- 8/65 Rule: Citi will only approve one new card every 8 days, and no more than two cards in a 65-day period.

- They also have a 48-month rule on cards in the same family. You have to wait 48 months between earning welcome bonuses on, for example, the Citi Premier and the Citi Rewards+.

- If you closed a card in the same product family within the last 48 months, that can also make you ineligible for a new bonus.

Always read the terms closely before applying.

Barclays

Barclays doesn’t publish specific rules, but they are known to be more conservative than some other banks.

They’re more likely to approve you if:

- You don’t have a ton of recent applications

- You’re using the Barclays cards you already have

- You haven’t opened several new cards in a short period of time

In other words, if you’re going after a Barclays card, apply when things have been quiet on your credit report and you’ve shown steady use of their products.

What Is Application Velocity?

You might have heard me say that Chase is especially sensitive to application velocity. What that means is they care about how quickly you apply for multiple cards, even if you’re technically eligible.

For example, Chase often won’t approve you if you apply for more than one card within 30 days. That’s why I usually suggest applying for a business card first and waiting about 30 days before applying for a second Chase card.

This is especially important if you’re working toward something like the Southwest Companion Pass, where you need to be approved for two Southwest cards.

Giving your applications some breathing room can make a big difference in getting approved.

Why You Need a Card Tracker

Between Adam and me, we have more than a dozen credit cards. It’s how we’ve earned hundreds of thousands of points to book flights, hotels, and incredible trips for a fraction of the cost. But it’s easy to lose track of what we’ve applied for, when bonuses post, when annual fees hit, and whether we’re eligible for a card again.

That’s why we use a simple credit card tracking spreadsheet. It keeps everything in one place and helps us stay organized as we build out our strategy. You can grab a copy below and customize it for your own system and track:

- What you’ve applied for

- When your welcome bonuses posted

- When you’ll be eligible for another card

- Which cards you might want to cancel or downgrade

Keep Your Strategy on Track

Download the spreadsheet I use to track all of our cards. It’ll help you stay organized, remember key dates, and apply with confidence.

Get the Free TrackerEditorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply