Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

What Is the 5/24 Rule?

If you’ve started researching travel credit cards, you may have come across something called the 5/24 rule: an unofficial but widely accepted policy from Chase Bank that can dramatically impact your approval odds.

Put simply:

If you’ve opened 5 or more personal credit cards (from any bank) in the past 24 months, Chase will likely decline your new credit card application.

Yes, even if your credit score is excellent.

Why It Matters

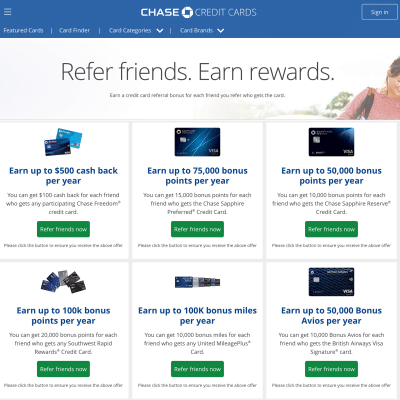

Chase offers some of the most valuable travel cards on the market, including:

- Chase Sapphire Preferred®

- Chase Sapphire Reserve®

- Ink Business Preferred®

- Southwest Rapid Rewards® cards

- World of Hyatt® and IHG® cards

If you want to build a strong points strategy, these are foundational. But if you’re over 5/24, you’ll be locked out, which is why timing your card applications is so important.

Which Cards Count Toward 5/24?

Chase counts most personal credit cards you’ve opened in the last 24 months, regardless of the bank.

Counted:

- Personal cards from Amex, Capital One, Citi, Wells Fargo, etc.

- Retail cards (like store cards from Target or Amazon)

Not Counted:

- Business credit cards from Amex, Chase, Capital One, etc.

(as long as they don’t report to your personal credit report) - Charge cards from Amex that are business-branded

- Loans, auto leases, etc.

Authorized Users: Do They Count?

Yes, authorized user cards often count toward your 5/24 total, even if you’re not the primary cardholder.

How to Check Your 5/24 Status

There’s no official Chase tracker, but you can:

- Pull your credit report (free at annualcreditreport.com)

- Count how many personal cards you’ve opened in the last 24 months

- Exclude business cards (unless they show on your personal report)

- Include authorized user cards

What If You’re Over 5/24?

If you’re already over the limit:

- Focus on earning points with your existing cards

- Explore business card options (they won’t add to 5/24)

- Set a reminder for when older cards drop off your 24-month window

Final Thoughts

The 5/24 rule may seem frustrating at first, but it’s actually an opportunity because it forces you to be intentional. Chase cards are often the best first step in a long-term travel rewards strategy, so starting with them makes sense.

And if you’re not sure what your 5/24 status is or which card to apply for next…

Not Sure Where You Stand with 5/24?

I offer free personalized credit card consultations to help you:

- Figure out your 5/24 status

- Apply for cards in the best order

- Maximize welcome offers without getting shut out

Request Your Free Consult

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply