If you subscribed to the teachings of Dave Ramsey like I did, you were taught that credit cards are the root of all evil and to avoid them at all costs. While Papa Dave does have some sound strategies to help folks get out of debt quickly and effectively, I believe writing off credit cards completely can be short-sighted.

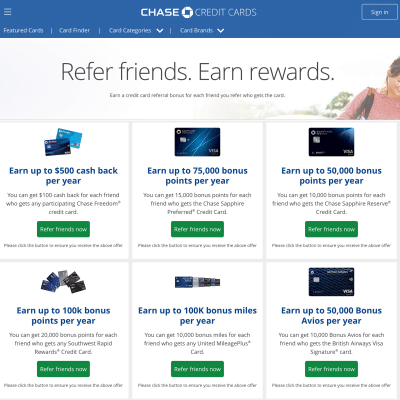

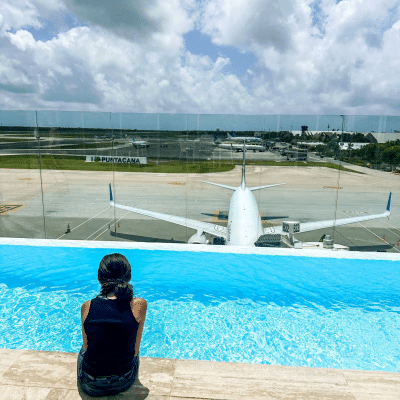

If you’re not in debt and are able to use credit cards responsibly, credit cards can be quite lucrative and rewarding financial tools! They can help you build or rebuild credit, maintain a good a credit score, and protect you from fraud. They’re a great tool for racking up airline miles, hotel points, and other travel rewards, and for earning cash back on purchases.

Before we dispel some of the myths surrounding credit cards, let’s take a look at how your credit score is determined.

What Makes Up Your Credit Score?

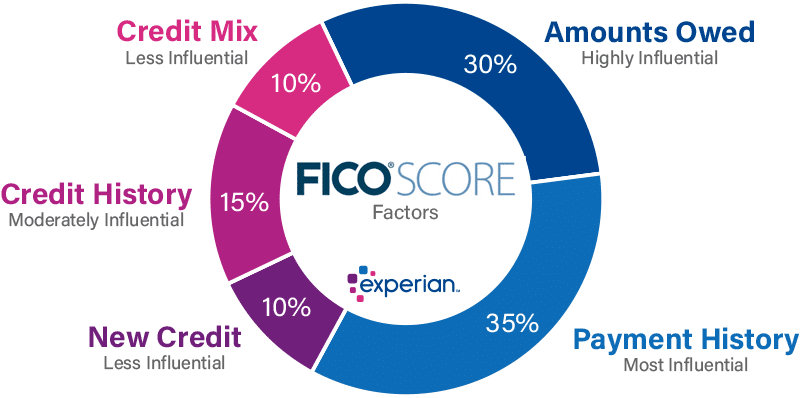

Your credit score is determined by 5 main factors:

- Payment History

- Credit Utilization (Amounts Owed)

- Length of Credit History

- Credit Mix

- New Credit

Payment history makes up roughly 35% of your credit score and shows how you pay back the credit you use. Because it makes up the biggest chunk of the pie chart, it’s imperative to pay your bill on time. It’s best if you can pay the balance in full so you don’t incur any high interest fees (which ultimately negates any rewards you may earn).

Credit utilization is the next biggest thing that determines your credit score. It refers to the amounts owed relative to the credit limits extended to you. In other words, having a high credit limit with low usage is a good thing! This shows that lenders are comfortable extending credit to you and that you don’t abuse that loan by maxing out your credit limits. It’s best to keep your credit utilization under 30%. For example, if you have a $10,000 credit limit, try to keep your monthly bill under $3,000.

The length of your credit history is the next determining factor. Obviously, having a long history of good credit is the goal. And don’t close your oldest credit card! Closing a card can shorten the length of your overall credit history as well as decrease your available credit line, which in turn impacts your credit utilization (remember? We want a high credit limit with low usage).

The last two determining factors, credit mix and new credit, are the least influential in your credit score, making up about 10% each of the pie chart. Credit mix refers to how diversified your credit is: home loan, auto loan, credit cards, etc. New credit is just that: how many account inquiries you have and how often you’re opening up new credit lines. Opening up too many credit cards too fast is not good for your credit and can be seen as risky and irresponsible to lenders. Your credit card strategy is a marathon, not a sprint.

Credit Card Myths

Myth: Opening a credit card will hurt my credit score.

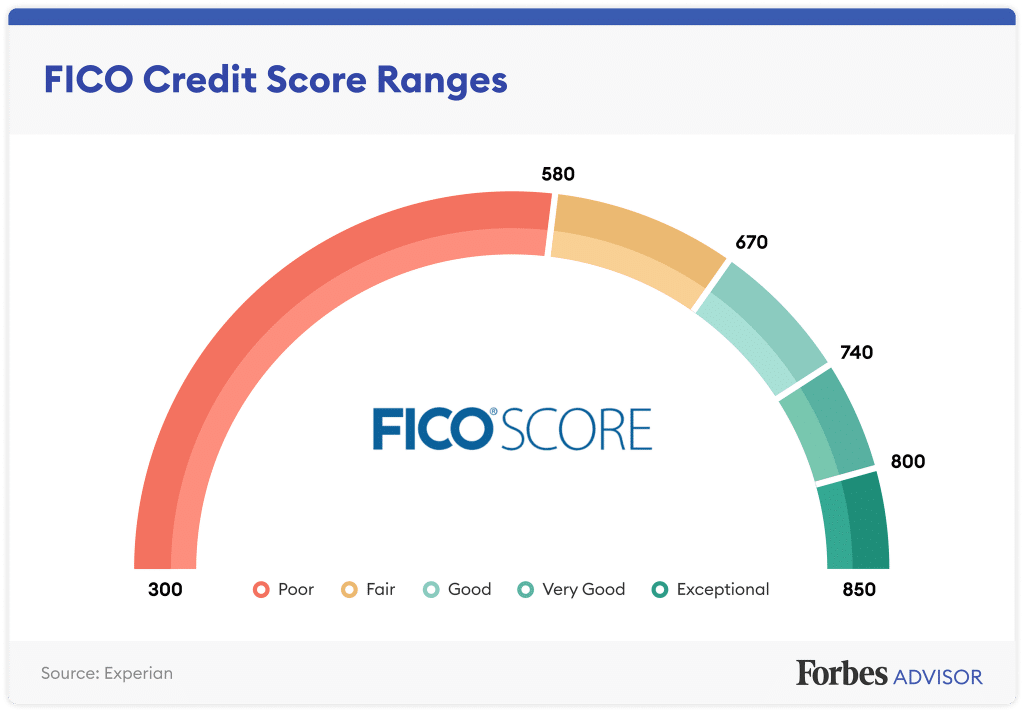

Truth: Well, sort of, but there’s a lot more to this story. When you apply for a credit card, the lender pulls your credit history. This is called a “hard pull” or “hard inquiry.” A hard pull results in a temporary dip in your credit score, but a single inquiry isn’t likely to have a significant effect. In my experience, whenever I apply for a new credit card, I see my credit score lower slightly (about 3-11 points), but after about 2 months, it fully recovers and is back in the excellent range because I keep my credit utilization under 30% and pay the bills in full and on time.

Myth: Closing unused credit cards will help your credit.

Truth: Doing so can actually damage your credit score! Closing a card that you’ve had for years not only shortens the length of your credit history, but it also decreases your overall credit line. By closing the card, the total amount of your available credit decreases, which can negatively impact your credit utilization ratio. If you have credit cards with a $0 annual fee, there’s no reason to close it. This card is helping your credit score without any out-of-pocket expense. To keep it active without much effort, put a small expense on it (like a Netflix subscription) and set it to autopay.

Myth: You need to carry a balance to build credit.

Truth: It’s best to pay your credit card balance in full each month. When you don’t pay the balance in full, it’s carried over to the next billing cycle and you typically accrue (usually high) interest on your unpaid balance. Since our goal with travel hacking is to travel for (nearly) free, we don’t want to pay for any extra fees!

Myth: Having multiple credit cards is bad for your credit score.

Truth: The number of cards under your name isn’t used in calculating your credit score. If you can be responsible and stay organized, having multiple credit cards will have a positive impact on your credit score. However, you’ll want to space out your credit card applications – too many hard pulls within a short period of time can appear to lenders as though you’re facing financial difficulties.

Bottom Line

When used responsibly, credit cards can be a powerful and rewarding personal finance tool. They can protect you from fraud, help you build and maintain good credit, and allow you to travel for (nearly) free. It’s imperative to have a smart credit card strategy. Feel free to fill out this form if you want me to put together a free personalized credit card strategy for you, based on your travel goals and the best credit card offers available.

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply