Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

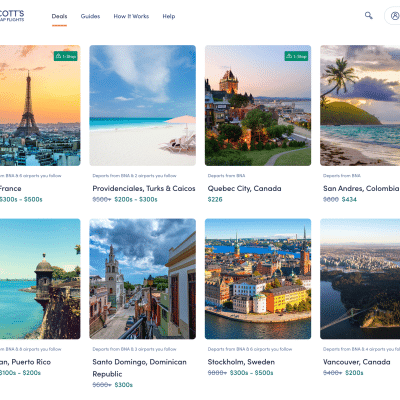

If you read my post on how I use Google Flights to strategically plan award travel, you already know that booking a trip with points starts way before you search for flights. Before you can book award travel with points and miles, you have to earn them. In this post, we’ll walk through the foundational strategy for earning flexible, transferable points through both personal and business credit cards.

Why Amex Is a Key Player in the Points & Miles World

American Express Membership Rewards® points are some of the most valuable and versatile in the game. I’ve personally had a strong relationship with American Express for over two decades. They have a great lineup of transfer partners across all three major airline alliances. That means your Amex points can help you book flights on Delta, Air France, ANA, Emirates, and more.

Two of the most popular cards in their lineup are:

Both offer robust earning potential and premium benefits like lounge access, travel credits, and high points multipliers on everyday spending.

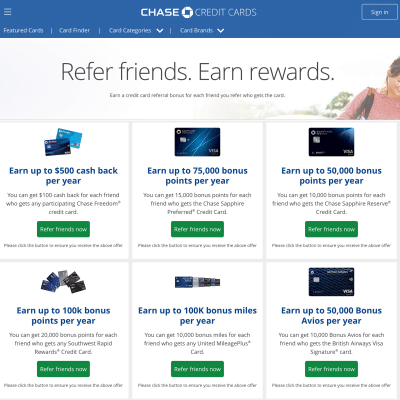

Pro tip: If you’re just getting started, I usually recommend opening Chase cards first. Chase restricts approvals for people who have opened 5+ cards in the past 24 months, so it’s best to start with them before moving on to Amex and others.

Amex Gold & Platinum — Are They Worth It?

Short answer: YES! The Amex Gold Card earns 4x points at restaurants and U.S. supermarkets, and the Platinum Card® from American Express unlocks premium perks like airport lounge access, travel credits, and more.

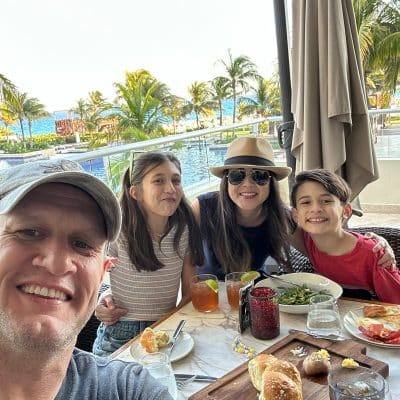

In our case, my husband Adam is active-duty military, so we benefit from waived annual fees, which makes these high-end cards a no-brainer for us. But even without that perk, many travelers find these cards worth the fee thanks to the value of the points and benefits.

Just remember: terms apply and enrollment is often required for select benefits. Always check with the issuer for current details.

Which Amex Card Should You Get First?

American Express has a once-per-lifetime rule on welcome offers for each card product. That means if you open one card, you may be disqualified from earning a bonus on a related card in the future.

For example, if you get The Platinum Card® from American Express first, you may not qualify for the American Express® Gold Card welcome offer later, so it’s important to plan your application strategy accordingly.

A common strategy is to:

- Start with the American Express® Green Card to establish your Membership Rewards® account and earn a solid welcome offer

- Then apply for the American Express® Gold Card to take advantage of strong everyday earning potential

- Finally, add The Platinum Card® from American Express if you value premium travel perks like lounge access and statement credits

You can always check your welcome offer eligibility on the American Express site before applying.

Need Help Choosing the Right Card Strategy?

I offer free personalized credit card consultations to help you:

- Establish a smart strategy that sets you up for long-term success

- Maximize welcome offers while staying within issuer rules

- Earn smarter based on your spending habits

- Build a plan tailored to your travel goals

Who Can Get a Business Credit Card?

This surprises a lot of people, but you don’t need an LLC or formal business entity to qualify for a business card. If you earn income outside of a W-2 job, you may be eligible.

Here are a few examples of what counts:

- Freelance work (photography, writing, consulting)

- Selling on Etsy or Facebook Marketplace

- Teaching music lessons

- Owning rental property

- Reselling clothes on Poshmark

You can typically apply as a sole proprietor using your own name and Social Security number. And here’s the best part: most business cards don’t show up on your personal credit report, so they won’t impact your Chase 5/24 status. Learn more about what qualifies as a business in this helpful Experian article.

My Favorite Business Cards Right Now

Here are a few standouts in the business card world:

- Amex Business Gold Card: earns 4x points in your top two business categories (from a select list) each billing cycle.

- Chase Ink Business Preferred®: great signup bonus, 3x points on travel, shipping, internet/phone services, and select advertising.

- Chase Ink Business Cash®: earns 5% cash back (or 5x points if paired with a premium card) on office supply stores and internet/phone/cable.

- Chase Ink Business Unlimited®: earns 1.5% cash back on everything (again, can be converted to points with the right card pairing).

Each of these cards has unique strengths, and many of them come with strong welcome offers and solid long-term value. (Terms apply.)

Homework: What’s In Your Wallet?

If you’re just getting started, now’s a great time to take inventory:

- What credit cards do you currently have?

- What points are you earning, and how do they transfer?

- Could you be eligible for a business credit card to help you diversify your points strategy?

- Are you within the Chase 5/24 rule?

And don’t forget to download the free Transfer Partner Cheat Sheet if you haven’t already!

Free Download: Credit Card Transfer Partner Cheat Sheet

Book smarter with points. This beautifully designed cheat sheet shows you which credit card points transfer to which airline partners so you can maximize every mile.

Get my Free Cheat Sheet!Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply