JenWoodhouse.com is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Last week, I gave you a brief overview of how I was able to book our family vacation to Washington, D.C. for under $500 (flights and hotel) as well as shared my hotel email template I use to get complimentary suite upgrades. In this post, I’ll go over some of the broad strokes of how I strategize and leverage points and miles to travel for nearly free and how you can get started doing the same.

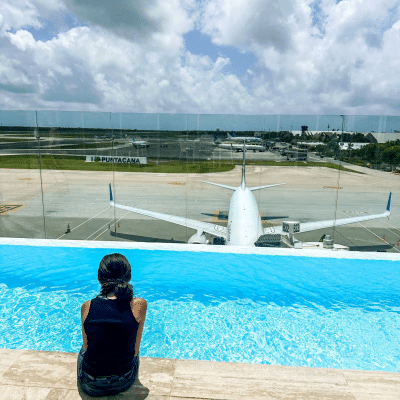

The first thing I do is start with a travel goal in mind and work backwards. Spending some of my formative years living in Germany, I have such fond memories of the Christmas markets all across Europe, so I set a goal to take my family to Europe over Christmas time. Once I had the destination in mind, I could start researching the points and miles I needed to get there. Happy to report, I met my goal and booked a 2-week trip to Europe by redeeming airline miles, credit card and hotel points, and paying about $1,600 per person total. This cost covers 4 round-trip flights with comfortable lay-down seats in business class and hotel stays in 3 different countries!

Budget Breakdown:

- (4) Round-trip business class flights from the US to Europe: $750.45/person

- (2) Luxury hotel rooms for 3 nights: 144.13 EUR/night

- (2) Luxury hotel rooms for 4 nights: 148.75 EUR/night

- (2) Mid-range hotel rooms for 3 nights: 266.67 EUR/night (I couldn’t find award availability for this property, which is why the price is so high.)

- (1) Mid-range hotel room for 1 night: $0/night

Total: $1,664.14 per person

Just out of curiosity, I priced this trip out had we paid the standard rates and it came to a whopping $33,000! Needless to say, that number is way beyond our budget.

Our Long Story Short

We have always lived debt-free and well below our means, having zero credit cards in our wallets. We paid cash for everything… even the last 2 vehicles we purchased (I’m kicking myself over how many points I missed out on)! We were long time Dave Ramsey disciples who heard Papa Dave preach often about the evils of credit cards and how they can easily and quickly lead to devastating financial ruin. While we agree to some extent, we also now realize that when used responsibly, credit cards can be quite lucrative, safe, and rewarding! Apart from the rewards programs and point redemptions, credit cards can offer protections against fraudulent charges where debit cards cannot.

Nowadays, we own several credit cards, but we still don’t carry any debt nor live above our means. We use our credit cards to pay for our monthly bills and everyday expenses, but we make sure to pay the statement balance in full every month. This way, our purchases are working for us, earning valuable rewards points that can be redeemed for dream vacations we’d never be able to afford otherwise.

Is Traveling On Points and Miles For Me?

The two most critical things to remember when using credit cards is to live below your means and pay off the entire statement balance every month so you don’t incur any interest fees (which can be ridiculously high). Interest fees would negate any redemption value you’d get from your points, and worse, plunge you into debt pretty quickly. So that “free vacation” ends up coming at a high cost.

If you have a good or excellent credit score and can pay off your credit card in full each month, then read on to learn how to leverage those valuable credit card points to book travel for (nearly) free! And if your credit score could use some help, here are 7 ways to improve your credit rating.

How Do I Get Started?

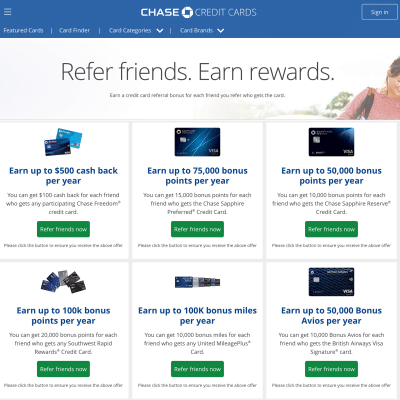

When you open up a credit card, they often come with a welcome offer or sign-up bonus. Welcome offers are the fastest way to earn a big chunk of points. The offer will usually have stipulations (e.g. earn X points if you spend X dollars within X months). Once you spend the required amount within the required timeframe, you’ll earn the welcome points, which you can then redeem for flights and/or hotel stays.

One of the best cards I recommend opening for valuable travel redemptions is the Chase Sapphire Preferred. There are a lot of different reasons why I recommend this card over others, but the main reason is because the points earned through the Chase Ultimate Rewards program are what’s called “flexible points,” meaning, you can transfer Chase UR points to various airlines, hotels, cruise lines, and rental car agencies. Whereas if you have a “brand-specific” card – like a Best Buy card, for example – you can usually only redeem those points for Best Buy purchases (not very useful when you want to book luxury travel).

Welcome bonuses often change, but at the time of this post, Chase is offering a 60,000 point sign-up bonus if you spend $4,000 on purchases within the first 3 months of opening the account. There’s a $95 annual fee on this card, but many of the card benefits far outweigh that fee.

So, what is 60,000 points worth? Well, it depends… and here’s where the strategy of getting the best point redemptions comes in. You can redeem those points for cash back or impulse Amazon purchases, but that’s typically the least value you’ll get from your points. Instead, if you transfer those points to airline and hotel partners, your points will go a lot further and you can book that vacation you’ve been dreaming about! Generally speaking, 60,000 points can easily be a roundtrip ticket to Europe in economy or a one-way ticket in business class or a 3-night stay in a swanky hotel.

To meet that minimum spend requirement and earn the welcome bonus, put all of your normal, everyday expenses (groceries, gas, utility bills, etc.) on that credit card and pay it off when you get the statement. Even better if you have a large purchase coming up (new appliances? Christmas shopping? A medical procedure?) – take advantage of that large amount and put it towards meeting the minimum spend requirement.

Your Homework Assignment

First, begin with a goal in mind. Where in the world do you want to go? What destination would you like to cross off your bucket list? Once you set your goal, you can start working towards earning the points needed for that trip.

If you don’t have a specific destination in mind, that’s okay! You can still open up the Chase card and start earning flexible points so that when you are ready to start booking that trip, you’ll have the points to do it.

Second, if you don’t already have accounts with various airline loyalty programs, sign up (it’s free). There are 3 main airline alliances: Star Alliance, Oneworld, and SkyTeam; here are some of the major players:

- Air France (SkyTeam)

- American Airlines (Oneworld)

- British Airways (Oneworld)

- Delta (SkyTeam)

- Iberia (Oneworld)

- KLM (SkyTeam)

- Lufthansa (Star Alliance)

- Southwest (Non-Alliance)

- United Airlines (Star Alliance)

I’ll be back to talk more about smart credit card strategies, including how your favorite person can fly with you for free for nearly 2 years, so don’t miss out!

Leave a Reply