Let’s talk a bit about the 5/24 rule because it’ll play into your credit card strategy pretty heavily. Chase bank has an unwritten rule called the “5/24 rule” in which Chase will automatically deny your credit card application for any Chase credit card if you’ve opened up more than 5 credit cards (from any issuer) within the last 24 months (5 credit cards / 24 months).

Any credit card that shows up on your personal credit history report, will count against your 5/24 status. When you apply for a Chase card, they’ll take a look at your credit report and see how many cards you’ve opened up in the last 24 months and if it’s more than 5 cards, then they won’t approve your application. Also, if you’re listed as an authorized user on someone else’s credit card, that takes up one of your 5 “slots” and counts against your 5/24 status. Most business credit cards, however, typically don’t show up on personal credit reports, so they shouldn’t count towards your 5/24 status.

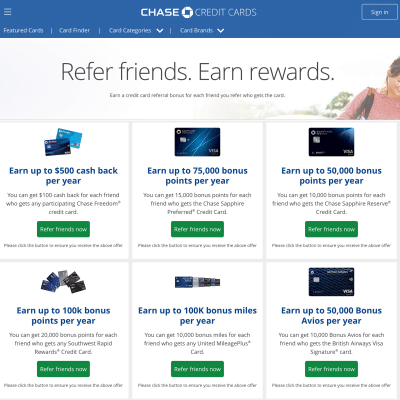

Other credit card issuers have similar restrictions, but this 5/24 rule is unique to Chase and they seem to be stricter than their competitors when approving credit card applications. This is why I recommend starting your points and miles journey with Chase. Get all the cards you want from Chase to fill those 5 slots first, and then you can move onto other credit card issuers (American Express, Capital One, etc.).

Chase has a lot of different cards to choose from, so regarding the order in which Chase cards to get, I recommend applying for the Chase Sapphire Preferred card and a Chase Freedom card first, and the remaining 3 slots can be whichever Chase card fits your lifestyle and will benefit you the most. Also, it’s wise to give yourself at least 60-90 days or more between credit card applications.

Leave a Reply