Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The Most Valuable Travel Benefit You Might Not Know About

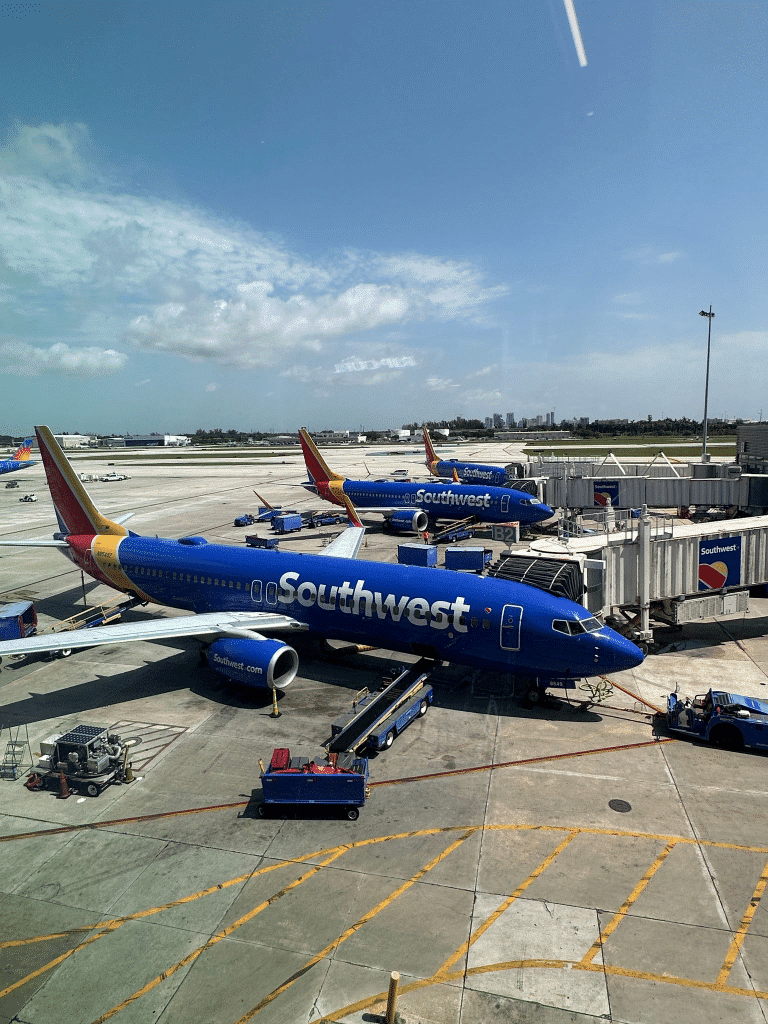

If you’re just getting started with travel points, the Southwest Companion Pass is one of the best places to begin. It’s an incredibly generous and surprisingly attainable perk that lets your designated companion fly with you for free. You’ll just pay taxes and fees on their ticket, which is typically about $5.60 one-way on domestic flights.

If you time it right, you could have this benefit for nearly two full years.

Let’s walk through how it works, how to earn it, and how to avoid common mistakes.

What Is the Southwest Companion Pass?

The Companion Pass lets you choose one person to fly with you for free every time you fly Southwest. It doesn’t matter whether your ticket is paid in cash or booked with points – your companion just pays taxes and fees.

Once you qualify, the pass is valid for the rest of the year you earn it and all of the following year.

So if you earn it in January 2025, you’ll be able to use it through December 2026.

How to Qualify

To earn the Companion Pass, you’ll need to accumulate 135,000 qualifying Rapid Rewards® points in a single calendar year.

You can earn those points in a few ways:

- Welcome bonuses from Southwest credit cards

- Points earned through spending on Southwest credit cards

- Flights you take on Southwest

- Shopping, dining, and hotel partners through the Rapid Rewards portal

The fastest path is through credit card welcome offers, especially if you open one personal and one business Southwest card.

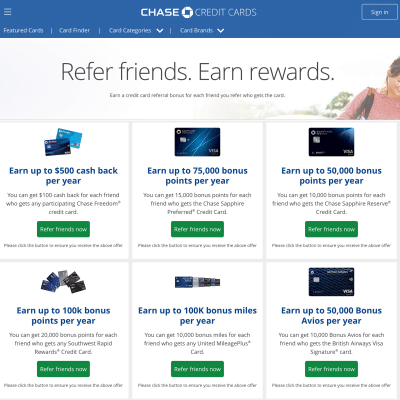

The Best Credit Card Strategy

Southwest currently offers three personal credit cards and two business cards through Chase. While offers vary, the most efficient way to earn the Companion Pass through welcome bonuses is to pair one personal card with the Southwest Performance Business Card.

Here’s the breakdown:

- The Southwest Performance Business Card frequently comes with a welcome offer of 80,000 points.

- Most personal cards regularly offer 50,000 points.

- That totals 130,000 points from the two welcome bonuses.

Here’s the key detail most people miss:

Just for holding a Southwest credit card, you’ll automatically receive 10,000 Companion Pass qualifying points each year. These points can’t be redeemed for flights, but they do count toward the 135,000 points required to earn the Companion Pass.

So with those two cards, you’d hit:

- 80,000 points from the business card

- 50,000 points from the personal card

- 10,000 qualifying points from cardholder status

- Total: 140,000 qualifying points

If you opt for the Southwest Premier Business Card, which often comes with a smaller bonus, you may fall short and have to make up the difference through spending or travel.

For most people pursuing the Companion Pass, the ideal combo is:

- One Southwest personal credit card

- The Southwest Performance Business Card

Just be sure both bonuses post in the same calendar year.

But timing and order also matter.

Chase is particularly sensitive to how many cards you apply for, and how quickly. This is sometimes referred to as application velocity. If you apply for multiple Chase cards too close together, even with a great credit score, your application might get declined.

Here’s what I recommend:

- Apply for the Southwest Performance Business Card first

- Wait at least 30 days before applying for the Southwest personal card

By spacing your applications this way, you give yourself the best chance of approval on both and reduce the risk of triggering Chase’s velocity rules.

Timing Is Everything

If you want to earn the Companion Pass for the longest possible time, when your points post matters just as much as how many you earn.

Here’s the ideal scenario:

You apply for both a Southwest personal credit card and a Southwest business credit card in October, November, or December. You’re approved, and your cards arrive soon after. However, you do not complete the minimum spend requirement until after January 1 of the new year. This ensures the bonus points from both cards post in the same calendar year.

Once your January statements close, your bonuses post to your Rapid Rewards account, and if you’ve met the total 135,000-point threshold, your Companion Pass is issued shortly after.

This strategy can give you the Companion Pass for nearly two full years.

Want a Step-by-Step Timeline to Earn the Companion Pass?

Download my free Southwest Companion Pass Strategy PDF. It breaks down exactly when to apply, when to spend, and how to make sure your points post in the right year.

Download the Free Strategy GuideCommon Mistakes to Avoid

- Earning points in two separate calendar years

- Opening two personal cards (you can only have one Southwest personal card at a time)

- Assuming any business can qualify (even a side hustle like freelancing or reselling can work, but you’ll want to be prepared to explain your business when you apply)

- Transferring Chase Ultimate Rewards® points to Southwest, thinking they’ll count toward the Companion Pass—they won’t

- Missing the best timing window by starting too late in the year

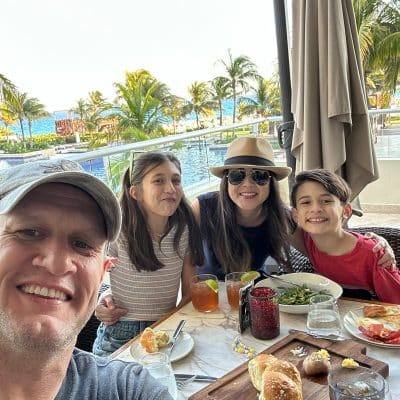

Why It’s Worth It

Let’s say you’re flying from Nashville to Denver. If your flight costs 6,000 Rapid Rewards points plus $5.60, your companion flies with you for just the $5.60.

This applies to every flight you book. And you’re not locked into one companion forever. You can change your designated companion up to three times per calendar year.

It’s one of the most flexible, high-value travel perks out there.

Final Thoughts

The Southwest Companion Pass is a powerful way to make your travel points go further. With just two credit card bonuses and the right timing, you can unlock nearly two years of two-for-one flights.

If you’re not sure when to apply, which cards to choose, or whether your business qualifies for a business card, I can help.

Ready to Start Your Companion Pass Strategy?

I offer free personalized credit card consultations to help you:

- Build a Companion Pass strategy based on your timeline

- Choose the best card combination

- Make sure your points post in the right year

Editorial Disclosure: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

User Generated Content Disclosure: Comments and opinions shared on this website do not reflect the views of the site owner or partners. Content submitted by users is not reviewed or endorsed.

Leave a Reply